Covid-19: Its impact on the automotive supply chain and lessons learned

The Covid-19 crisis has left an unprecedented impact on many sectors, including tourism, health, and retail. The automotive industry has also been hit hard by the pandemic as its supply chain was widely disrupted. Despite a gradual easing of government restrictions, the impact of the health crisis can still be strongly felt on the automotive industry.

China at the heart of automotive production and the Covid-19 crisis

The Covid-19 crisis has severely disrupted businesses in China, including many major producers of automotive parts. The city of Wuhan alone concentrates 9% of the Chinese automotive production and is home to hundreds of automotive suppliers. The historic center of PSA’s activities is also located in Wuhan since the mid-1990s.

Due to the health crisis, local production was forced to slow down and eventually stop. As a result, hundreds of factories were closed, production was hampered and stocks piled up as they could not be shipped to the rest of the world. Indeed, the delivery of various stocks (to customers, partners, etc.) was disrupted due to a lack of transport modes.

Many airlines suspended flights to and from China and the movement of cargo planes was restricted. Travels within the country were strictly controlled. Traffic limitations made it difficult to access ports and, ultimately, customers. Delivery trucks could leave some cities but could be prevented from returning due to restrictions imposed by Chinese authorities.

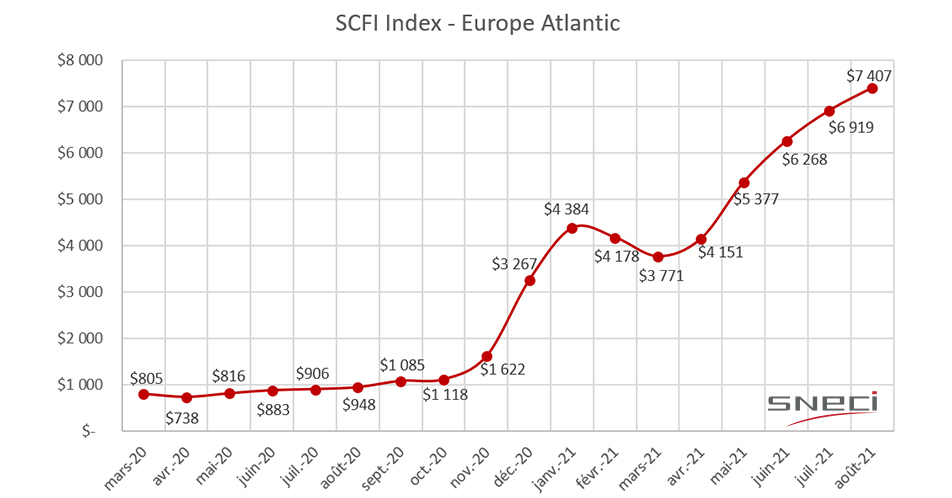

Maritime transport was also severely impacted. The majority of containers, which carried critical automotive parts, were no longer shipped to Europe, mainly due to a sharp drop in demand following the shutdown of factories and assembly lines. Container carriers and producers have thus reduced their fleets on trade routes by 30%. As for the rest of the containers, they were sent to the United States where activities related to automotive production continued with the same dynamism in accordance with the “America First” policy of the former US President Donald Trump. This situation quickly led to a shortage of containers in Europe, as soon as demand gradually started to pick up. Moreover, European carmakers had to deal with an unprecedented rise in the price of maritime transport, which has increased eightfold, with demand being much greater than supply.

Source: SNECI

This graph highlights the unusual rise in container prices towards the end of 2020, once the global economy started to recover.

Such an outcome shows that a supply chain disruption in one country only can spread very quickly to the rest of the world. It also underlines a strong dependence of the European automotive industry on certain key actors, particularly from Asia.

Indeed, the major players that dominate battery manufacturing (including those equipping electric cars), are LG Energy Solutions, CATL, Panasonic, BYD, Samsung SDI, and SK Innovations. These are mainly companies based in China, Japan, or South Korea. Some of them supply to car manufacturers such as Renault, Mercedes, and Volkswagen. Therefore, the interruption of their production has a direct impact on the activities of European OEMs. The latter, not being able to receive the necessary parts, were forced to stop their production as well.

Production plants in full and/or partial shutdown across Europe

Because of the pandemic, almost all European car manufacturers were forced to put their production on hold for at least a certain period of time. Many of them had no choice but to partially or permanently close their factories and production lines.

The French carmaker Renault had to close 12 production sites in France in March 2020, which impacted the jobs of over 18,000 employees. Such restrictive measures were also extended to its production plants located abroad (Spain, Morocco, and Portugal). Indeed, Renault had to protect its employees in this particular context as well as comply with the sanitary measures imposed by the French and other governments. Later on, the company had to slow down and even close more of its production lines due to a strong decrease in consumer demand.

On the German side, BMW had closed several of its factories in Europe and South Africa. Volkswagen was also forced to shut down its assembly lines last May to “continuously align production with expected market fluctuations”. As for Audi, the brand had to suspend the majority of its production in Europe, alongside the activity of certain administrative services. This suspension was mainly applied to car, van, and utility vehicle factories.

The FCA group (which became Stellantis since the merger with PSA Groupe) also suspended the activity of several production plants in Europe, primarily in Italy.

European carmakers are still struggling to resume their normal activity. This has become even harder following the semiconductor crisis that the automotive industry is facing today.

The semiconductor supply crisis

The Covid-19 crisis has weakened automotive supply chain, which is currently experiencing a major shortage of semiconductors, the electronic chips essential in any modern electronic system.

A combination of several factors led to this severe crisis.

In the first half of 2020, the automotive industry faced a fall in demand. At the same time, the switch to work-from-home due to the sanitary measures and the increased need for connectivity have led to a considerable rise in the demand for electronic equipment (personal computers, video games, communication means). The production of these appliances requires many semiconductors.

Consequently, the companies producing chips have concentrated their efforts on the tech sector, which has proven to be much more profitable than the automotive industry. As a result, when demand from the automotive sector picked up faster than expected in the second half of 2020, the semiconductor industry had already redirected most of its production to meet the demand of other more lucrative fields.

Furthermore, the fire at the Naka plant in Japan owned by Renesas Electronics (one of the three largest semiconductor suppliers) in March 2021caused more damage than expected. It resulted in longer delivery times, further aggravating automotive supply chain interruptions.

This chip deficiency had direct consequences on car manufacturers.

Stellantis predicted that 1,400,000 vehicles won’t be produced in 2021 because of this shortage.

The American giant General Motors has recently estimated that the shortage of semiconductors could cost the company between 1.5 and 2 billion dollars.

In September 2021, Toyota, which until recently was not affected by this crisis, has announced a reduction in its global production of 40% compared to what it had expected (900,000 cars) due to a deficit of automotive parts.

This semiconductor shortage revealed the vulnerability of the automotive industry to various crises or supply chain disruptions alongside its heavy dependence on key chip producers.

Today, three companies dominate semiconductor production: the American Intel, its South Korean competitor Samsung, and the TSMC group, based in Taiwan. The slightest problem encountered by these companies directly impacts carmakers and other automotive actors around the world.

After surviving this unprecedented crisis, manufacturers and other automotive players are trying to find alternatives and solutions to improve their supply chains resilience.

Towards a better resilience of the automotive supply chain

Several measures can be taken to reduce the risks surrounding the automotive supply chain.

First of all, it would be appropriate to relocate the supply sources and the manufacturing of automotive parts to the same geographic area with the final client (carmaker). It would give automotive actors more real-time visibility along the entire supply chain. Some production sites could also be partially moved from Asia to Eastern Europe. This is one of the reasons why SNECI has been established in this region.

Moreover, it is also important to establish coherent risk management practices. In fact, the Covid-19 crisis has underlined the need to involve all automotive supply chain actors in the search for an effective risk management approach.

Prospects for the automotive industry recovery

It seems unlikely that the semiconductor crisis will end in the short term, especially due to the complexity of the chip manufacturing process. Moreover, their volume and sophistication level are constantly increasing with a rising necessity to equip new elaborated technologies such as advanced driver assistance systems.

Many carmakers and Tier 1 suppliers seek to collect and analyze more precisely the information about semiconductors’ value chain and their manufacturing sites in order to have better anticipation of the evolution of chip supply and demand.

In the long term, the automotive industry will have to rethink the way it structures and deals with semiconductor supply contracts. This can be achieved through the establishment of a more balanced risk-sharing plan aligned with the entire value chain. Moreover, manufacturers should reconsider the current “just in time” practice. It will include opting for a regional supply to reduce their dependence on suppliers having a certain monopoly or being geographically far away.

Anaïs Docus, Logistics and Costing Expert at SNECI, also shares her feelings about this situation: “Personally, I think that the additional costs linked to maritime transport and the financial loss due to the semiconductor crisis are such that car manufacturers are now ready to begin a total reorganization of their supply chain or even more, aiming for long-term cost-effectiveness. The Covid-19 crisis was a trigger that emphasized the extreme dependence of automakers on big shipping companies and a few materials flows. For example, semiconductor producers that, as we know already, are very regionalized”. In addition, Anaïs believes that “the environmental impact linked to maritime transport and the production of silicon-based electronic components will require, in the long term (since resources are limited), a reorganization of the economy, whether through the intervention of an external entity or by pressure, through the establishment of a more viable model”.

To conclude, it seems more than ever necessary that various automotive actors opt for a cooperative approach and share common objectives in order to develop solid strategies, supporting a faster recovery of the industry.